-

Reading these 570,000 words is like reading a detailed manual on how to do anything, such as playing golf or a violin. It takes a lot of hard work to turn the information into the ability to make a living as a trader, but it is impossible without understanding how markets work. Like being a professional golfer or violinist, no matter how good you get, you always want to be better, so the challenge and satisfaction last long after you become consistently profitable.

-

Everything that you see is in a gray fog. Nothing is perfectly clear. Close is close enough. If something looks like a reliable pattern, it will likely trade like a reliable pattern.

-

There is no easy set of reliable rules to make money as a trader, and everything is subjective. This is a zero-sum game with very smart players, so when an edge exists, it is small and fleeting. For a trader to make money, he has to be consistently better than half of the other traders out there (or more accurately, trade a positive trader’s equation more than half of the time). Since most of the competitors are profitable institutions, a trader has to be very good. However, edges appear constantly, and if you learn to spot them and understand how to trade them, you are in a position to make money.

-

The edge can never get very large because institutions would take advantage of it as it was growing. A trade cannot have a high probability of making a big reward relative to the risk.

-

Reading charts well is difficult, but it is only half of what you need to know to make money. You also need to learn to trade, which is just as difficult. Trading successfully always has been and will always continue to be hard to do, no matter what method you use. If there were an easy way to make money, everyone would do it and then there would be no trapped traders to drive the market to your target. Read a book that teaches you how to play the violin and then go out to see if the world will give you money to hear you play. Just because you understand how to do something does not mean that you can do it effectively, especially if it is difficult to do.

-

A trader needs a mathematical advantage to make money. At every moment, there is always a mathematical edge for both a long and a short trade, but the edges are usually not clear. When they are relatively clear, they are fleeting and small. However, those are the times when traders need to place their trades.

-

The ability to spot trades that have a positive trader’s equation is the key to success. That can mean buying above a bar on a stop, selling above a bar with a limit order, buying below a bar with a limit order, or selling below a bar on a stop.

-

The single most important determination that a trader makes, and he makes this after the close of every bar, is whether there will be more buyers or sellers above and below the prior bar. This is particularly true with breakouts and failed breakouts, because the move that follows usually determines the always-in direction and therefore lasts for many points and is not just a scalp.

-

Every time you buy above the high of the prior bar on a stop, someone else is shorting there with a limit order. When you sell one tick below the low of the prior bar, there is a strong bull who is taking the other side of your trade. Always remember that nothing is certain, and the edge is always small because there are smart people who believe the exact opposite of what you do.

-

Every bar, even a strong trend bar, is a signal bar for both directions, and the market can begin a trend up or down on the next bar. Be open to all possibilities, including the exact opposite of what you expect, and when the surprise happens, don’t question or deny it. Just read it and trade it.

-

Every time you look to enter a setup, make sure to consider what the market is telling you if instead it breaks out of the opposite end of the signal bar. Sometimes that buy setup that you see might in fact also be a great sell setup because it will trap longs who will cover below the low of the signal or entry bars.

-

Understanding trend bars that create breakouts is one of the most important skills that a trader can acquire. Traders need to be able to assess whether a breakout is likely to succeed, or it will be met with profit taking and a pullback, or it will be followed by a reversal.

-

Look for signs of strength and weakness and weigh them to determine if they give you an edge. If you see the market doing something, assess how strong the setup is. Did it fail to take an opportunity to do something strong? If so, the setup is weaker.

-

Whenever you are positive that your setup is good, don’t take the trade. You are missing something. You don’t see what the person who is taking the other side of your trade is seeing, and that person is just as smart as you are. Be humble. If you are too confident, your arrogance will make you lose because you will be using unrealistically high probabilities in your evaluation of the trader’s equation.

-

Much of life is not what it seems. In fact, the famous mathematician Charles Lutwidge Dodgson was not what he seemed to be and is better known as Lewis Carroll. We work in an Alice in Wonderland world where nothing is really as it seems. Up is not always up and down is not always down. Just look at most strong breakouts of trading ranges—they usually fail, and up is really the start of down and down is really just part of up. Also, 60 percent is 60 percent in only 90 percent of the cases and can be 90 percent sometimes and 10 percent at other times. If a good setup is 60 percent, how can you win 80 percent or more of the time? Well, in a pullback in a strong trend just above support, a setup might work 60 percent of the time, but if you can scale in as the market goes lower, especially if your subsequent entries are larger, you might find that you win in 80 percent or more of those 60 percent setups. Also, if you use a very wide stop and are willing to sit through a large drawdown for a couple of hours, that 60 percent chance of making two points before losing two points in the Emini might be a 90 percent chance of making four points before losing eight points. If you are flexible and comfortable with constantly changing probabilities and many probabilities coexisting, your chance of success is much greater.

-

The single most important thing that you can do all day is talk yourself out of bad trades. For example, if it is a trading range day, don’t look to buy after a strong bull trend bar or a high 1 near the top of the range, and don’t look to short after a strong bear trend bar or low 1 near the bottom of the range.

-

The market constantly exhibits inertia and tends to continue what it has just been doing. If it is in a trend, 80 percent of the attempts to reverse it will fail and lead to a flag and then a resumption of the trend. If it is in a trading range, 80 percent of the attempts to break out into a trend will fail.

-

If ever you feel twisted inside because a pullback is going too far, you are likely mistakenly seeing a pullback when in fact the trend has reversed.

-

If you think the market rationally should be going up, but instead it is offering you a strong sell setup, take it. Trade the trade that you have and not the one that you want or expect, because “the market can stay irrational much longer than you can stay solvent” (a quote attributed to John Maynard Keynes).

-

Price is truth. Never argue with what the market is telling you. For a day trader, fundamentals are almost entirely useless. The market will tell you where it is going and it cannot hide what it is doing. Neither you nor the experts on television can know how the market will react to the fundamentals, although those experts often speak with certainty. Since the market is rarely more than 60 percent certain of anything, whenever pundits speak with certainty, they are ignoring math and therefore the most basic characteristic of the market. If you follow someone who is indifferent to or ignorant of how markets work, you will lose money.

-

Everything makes sense. If you know how to read price action, nothing will surprise you, because you will understand what the market is doing. Beginners can see it on a printout at the end of the day. The goal is to learn how to read fast enough so that you can understand what is happening in real time.

-

“It’s not fair!” If that is how you are feeling, take a break from trading. You are absolutely right—it is not fair, but that is because it is all based on mathematics, and fairness is never one of the variables. If you are concerned about fairness, you are not synchronized with the market. Computer programs control all market activity, and they have no concept of fairness; they never get tired, they don’t remember what their last trade was, and they are relentlessly objective. Since they are making money, you need to try to emulate their qualities. They cannot hide what they are doing, and your job is to see what they are doing and then copy them. Yes, you will enter after their first entry, but they will continue to enter after you do, and they are the force that will drive the market far enough to give you your profit.

-

Price action is based on human behavior and therefore has a genetic basis. This is why it works in all markets in all countries and on all time frames and it has always worked and always will inescapably reflect human behavior, at least until we evolve into a new species.

-

Always have a protective stop in the market because it protects you from the greatest danger you will ever face as a trader. That danger is not the market, which could not care less whether you win or lose, never knows that you exist, and is never out to get you. It is yourself, and all of your inadequacies as a trader, including denial, arrogance, and a lack of discipline.

-

Thinking is very difficult. Losers prefer instead to look with religious zeal for a savior who will protect them from losing money. Saviors can be confident, impressive experts with outstanding credentials on TV, famous writers of newsletters, chat room leaders, indicators, or any other external idol into which traders infuse the power to protect them and take them to the Promised Land. Instead, they will all slowly suck the last dollar from your account. You will not make money until you do your own analysis and ignore all external influences that promise you success, but in fact exist only to make money for themselves and not you. The experts on TV hope to establish credibility that they can use to sell their services or get a promotion, the TV station makes money off commercials, the chat room and newsletter people sell their services, and the software company that gives you indicators does so for a fee. No one is going to help you in the long run, so never fool yourself into believing that you can make money with the help of all of those nice people.

-

Those who talk don’t know and those who know don’t talk. Don’t watch TV or read any news.

-

If you find that you did not take a couple of Emini trades in a row and they worked, you are likely trading too large a position size. Switch to trading 100 to 300 shares of SPY and swing for at least 20 to 50 cents. Even though you won’t get rich, at least you will make some money and build your confidence. If you think that you can comfortably trade three Emini contracts per trade, then you should trade just one. This will make it much easier for you to take every signal. If you trade three Eminis, you will let many good signals go because you really are comfortable trading only three contracts in the rare case of a perfect signal. You need to be trading a size where you are comfortable with any decent signal and remain comfortable if you lose two or three times in a row. One indicator of this comfort is your ability to take the next trade after those losses. If you feel too uncomfortable and are really waiting for perfection, you are still trading too much volume. Once you start cherry-picking, you are on the path to a blown account. Your emotions are a burden and give an edge to your opponents, as is the case in any competition.

-

“I don’t care!” That is the most useful mantra. I don’t care if I lose on this trade, because I am trading a small enough size that a loss will not upset me and cloud my judgment. I don’t care what the experts are saying on TV or in the Wall Street Journal. I don’t care what is happening on the 3 and 1 minute charts or on volume or tick charts, and I don’t care about missing all of the wonderful signals that those charts are generating, because if the trades really are good, they will lead to 5 minute signals as well. I don’t care that the market is way overdone and is due for a correction. I don’t care about indicators, especially squiggly lines that show divergences in a huge trend (meanwhile, there has been no trend line break), but I do care about the one chart in front of me and what it is telling me. I also care about following my rules and not allowing any outside influence talk me out of doing what my rules are telling me.

-

If you are afraid of taking a great trade because your stop would have to be too far, reduce your position size to maybe a quarter of normal so that your total dollar risk is no larger than for your usual trades. You need to get into the “I don’t care” mode to be able to take these trades. By cutting your position size, you can focus on the quality of the setup instead of being preoccupied with the dollars that you can lose if the trade fails. However, first spot a good setup before adopting the “I don’t care” mind-set, because you don’t want to be so apathetic about the dollars that you begin to take weak setups and then go on to lose money.

-

The market is never certain when it has gone far enough, but it is always certain when it has gone too far. Most reversals require excess before traders believe that the reversal will work. Market inertia can be stopped only by excess.

-

It is difficult to reverse a position. For most traders, it is far better to exit, even with a loss, and then look for another setup in the new direction.

-

There are no reliable countertrend patterns so, unless you are a consistently profitable trader, never trade countertrend unless there first has been a strong break of a significant trend line, and the signal is a reasonable setup for an always-in reversal. When you are shorting below that great bear reversal bar in a strong bull trend, far smarter traders are buying with limit orders at the low of your signal bar. When you are buying on a stop above a bull reversal bar in a strong bear trend, smarter traders are shorting exactly where you are buying. Since 80 percent of reversals fail, who do you think is making the money?

-

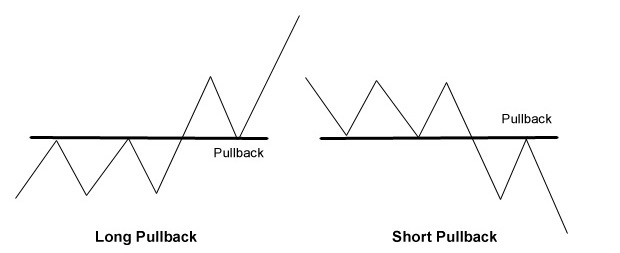

Any reversal setup is a good reason to take partial or full profits, but the setup has to be strong if you are considering a countertrend trade. Since 80 percent of reversals fail, it is far better to view each top as the start of a bull flag and each bottom as the start of a bear flag.

-

Too early is always worse than too late. Since most reversals and breakouts fail, an early entry will likely fail. Since most trends go a long way, entering late is usually still a good trade.

-

All patterns fail and the failures often fail, and when they do, they create a breakout pullback in the original direction and have a high probability of success.

-

When you see that one side is suddenly trapped, the reliability of a scalp in the opposite direction goes up. Trapped traders will be forced out as you are getting in, and they will likely wait for more price action before entering again in their original direction, so the only traders left will be in your direction.

-

Seeing traders getting trapped out of a trade on a stop run is as reliable a signal as seeing them getting trapped in a trade. If the market suddenly runs stops and then resumes its trend, this is a reliable setup for at least a scalper’s profit.

-

Wait. If the market has not given any signals for 30 to 60 minutes and you find yourself checking your e-mail or talking on the phone with your daughter away at college, and suddenly the market makes a large bull trend bar that breaks out of a trading range, wait. You’ve lost touch with the market and it is trying to trap you in. Never make a quick decision to place a trade, especially on a sudden, large trend bar. If it turns into a great trade and you miss it, you will still be ahead overall because the odds are against you when you take trades under these circumstances. Yes, some will be winners, but if you review all of the times that you took these trades, you will discover that you lost money.

-

You don’t have to trade. You goal as a trader is to make money, not to make trades, so take a trade only when it will help you achieve your goal. There will be many other signals all day long, so wait for a good one, and don’t be upset when you miss good trades. Many beginners want excitement and tend to overtrade. Many great traders find trading to be lonely and boring, but very profitable. Everyone wants to trade, but you should want to make money more than you want to trade. You should take only trades that are likely to make money, not simply relieve your tension from not having placed a trade in an hour or two.

-

Simple is better. You don’t need indicators, and you should look at only one chart. If you can’t make money off a single chart with no indicators, adding more things to analyze will just make it more difficult. Also, trade only the very best setups until you are consistently profitable. The single biggest problem with using two charts is that there is a natural tendency to take only signals that occur simultaneously on both charts, which rarely happens. You end up rejecting most of the day’s great signals because the second chart does not have a signal or the signal occurred two ticks earlier. For example, if you see a great high 2 pullback to the exponential moving average in a bull trend on the 5 minute chart and then look at the 2 or 3 minute chart and see that it gave an entry two ticks earlier, you might not take the 5 minute entry because you will be afraid that the move will stop at the 2 minute scalper’s target and never reach the 5 minute target.

-

Decide whether this is a hobby or a job. If it is a hobby, find another one because this one will be too expensive and it is dangerously addictive. All great traders are likely trading addicts, but most trading addicts will likely end up broke.

-

Begin trading using a 5 minute chart, entering on a pullback and using a stop order for your entry. When the market is in a bull trend, look to buy above a bull bar at the moving average. When it is in a bear trend, look to short below a bear bar at the moving average. Take some or all off on a limit order at a profit target around the prior extreme of the trend, and then move the protective stop to breakeven on any remaining contracts.

-

When starting out, you should consider trading the SPY instead of the Emini. One Emini is virtually identical to 500 SPY shares, and trading 200 to 500 SPY shares would allow you to scale out as you swing part of your trade, yet not incur much risk. Once you reach 1,000 to 1,500 SPY shares, if you are thinking that you will continue to increase your position size, then switch to the Emini. At that size, you can scale out of the Emini and you can increase your position size tremendously without slippage being a significant issue.

-

Buy low and sell high, except in a clear and strong trend (see Part I in book 1 on trends). In a bull trend, buy high 2 setups even if they are at the high of the day; in a bear trend, sell low 2 setups. However, the market is in a trading range for the vast majority of the time. For example, if the market has been going up for a few bars and there is now a buy signal near the top of this leg up, ask yourself if you believe that the market is in one of the established clear and strong bull trend patterns described in these books. If you cannot convince yourself that it is, don’t buy high, even if the momentum looks great, since the odds are great that you will be trapped. Remember Warren Buffett’s version of the old saw, “Be afraid when others are greedy and be greedy when others are afraid.”

-

The two most important feelings for the media and for beginners are fear and greed. Profitable traders feel neither. For them, the two most important feelings are uncertainty (confusion) and urgency, and they use both to make money. Every bar and every segment of every market is either a trend or a trading range. When a trader is certain, the market is in a strong trend. When he feels a sense of urgency, like he wants to buy as the market is going up (or short as it is going down) but is desperate for a pullback, the market is in a strong trend. He will buy at least a small position at the market instead of waiting for a pullback.

-

When a trader is uncertain or confused, the market is in a trading range and he should only buy low and sell high. If he wants to take many trades, only scalp. Uncertainty means that the market has a lot of two-sided trading and therefore might be forming a trading range. Since most breakout attempts fail, it is better to only look to short if you are uncertain and the market is up for five to 10 bars, and only look for longs when it is down for five to 10 bars.

-

When there is a trading range, buy low means that if the market is near the bottom of the range and you are short, you can buy back your short for a profit, and if there is a strong buy signal, you can buy to initiate a long. Likewise, when the market is toward the top of the range, you sell high. This selling can be to take your profit on your long, or, if there is a good short setup, you can sell to initiate a short position.

-

Good fill, bad trade. Always be suspicious if the market lets you in or out at a price that is better than you anticipated. The corollary of bad fill, good trade is not as reliable.

-

The first hour or two is usually the easiest time to make money, because the swings tend to be large and there are not many doji bars. The first hour is the easiest time to lose money as well, because you are overly confident about how easy it might be, and you don’t follow your rules carefully. The first hour usually has many reversals, so patiently wait for a swing setup, which will generally have less than a 50 percent chance of success but a potential reward that is at least twice as large as the risk. Experienced traders can scalp. If you don’t follow your rules and are in the red, you’ve missed the easiest time of the day to make money, which means that you will be unhappy all day as you hope to get back to breakeven in trading that is much slower and less profitable.

-

If you are down on the day and you are now in the second half of the day, it can feel like you are swimming in quicksand—the harder you try to get out, the deeper you sink. Even great traders simply fail to connect emotionally with the flow of the market some days and they will occasionally lose, even though a printout of the 5 minute chart at the end of the day will be shockingly clear. The smartest thing to do is just make sure that you follow your rules into the close, and you will likely win back some of your losses. The worst thing to do is to modify your trading style, which is probably why you are down on the day. Don’t increase your position size and start trading lower-probability setups. If you have an approach that makes you money, stick with it and you will earn back your loss tomorrow. Using a different approach will only cost you more.

-

Beginners should avoid trading in the middle of the day when the market is in the middle of a day’s range, especially if the moving average is relatively flat and the trading range is tight and has prominent tails (barbwire). When you are about to take any trade, always ask yourself if the setup is one of the best of the day. Is this the one that the institutions have been waiting for all day? If the answer is no and you are not a consistently profitable trader, then you should not take the trade, either.

-

A tight trading range is the worst environment for entering on stops. The institutions are doing the opposite, and you will consistently lose if you insist on trading, hoping that a trend is about to begin.

-

A tight trading range trumps everything. That means that it is more important than every good reason that you have to buy or sell. Unless you are a great trader, once you sense that a tight trading range might be forming, force yourself to not take any trades, even if you don’t trade for hours.

-

Every bar and every series of bars is either a trend or a trading range. Pick one. Decide on the always-in direction and trade only in that direction until it changes. Throughout the day and especially around 8:30 a.m. PST, you need to be deciding whether the day resembles any trend pattern described in these books. If it does and you are looking to take any trade, you must take every with-trend trade. Never consider taking a countertrend trade if you haven’t been taking all of the with-trend trades.

-

The best signal bars are trend bars in the direction of your trade. Doji bars are one-bar trading ranges and therefore usually terrible signal bars. You will usually lose if you buy above a trading range or sell below one.

-

Most countertrend setups fail, and most with-trend setups succeed. Do the math and decide which you should be trading. Trends constantly form great-looking countertrend setups and lousy-looking with-trend setups. If you trade countertrend, you are gambling and, although you will often win and have fun, the math is against you and you will slowly but surely go broke. Countertrend setups in strong trends almost always fail and become great with-trend setups, especially on the 1 minute chart.

-

You will not make consistent money until you stop trading countertrend scalps. You will win often enough to keep you trying to improve your technique, but over time your account will slowly disappear. Remember, your risk will likely have to be as large as your profit target, so it will usually take six winners just to get back to breakeven after four losses, and this is a very depressing prospect. Realistically, you should scalp only if you can win 60 percent of the time, and most traders should avoid any trade where the potential reward is not at least as large as the risk. Beginners should scalp only with the trend, if at all.

-

Until you are consistently profitable, take only trades where your potential reward is at least as large as your risk. If you need to risk two points in the Emini, do not take your profit until you have at least two points. Most traders should not scalp for a reward that is smaller than the risk, because they will lose money even if they win on 60 percent of their trades. Remember the trader’s equation. The chance of winning times your potential reward has to be significantly greater than the chance of losing times your risk. You cannot risk two points to make one point and hope to make a profit unless you are right at least 80 percent of the time, and very few traders are that good.

-

The trader’s equation has three variables, and any setup with a positive result is a good trade. This can be a trade with a high probability of success and a reward only equal to the risk, one with a low probability of success and a huge reward relative to risk, or anything in between.

-

Experienced traders can scale into (or out of) trades to improve their trader’s equation. For example, the initial entry might have a relatively low probability of success, but subsequent entries might have significantly higher probabilities, improving the trader’s equation for the entire position.

-

You will not make money until you start trading with-trend pullbacks.

-

You will not make money trading reversals until you wait for a break of a significant trend line and then for a strong reversal bar on a test of the trend’s extreme.

-

You will not make money unless you know what you are doing. Print out the 5 minute Emini chart every day (and stock charts, if you trade stocks) and write on the chart every setup that you see. When you see several price action features, write them all on the chart. Do this every day for years until you can look at any part of any chart and instantly understand what is happening.

-

You will not make money in the long term until you know enough about your personality to find a trading style that is compatible. You need to be able to follow your rules comfortably, allowing you to enter and exit trades with minimal or no uncertainty or anxiety. Once you have mastered a method of trading, if you feel stress while trading, then you haven’t yet found either your style or yourself.

-

You will not make money if you lose your discipline and take risky trades in the final couple of hours that you would never take in the first couple of hours. You will invariably give back those earnings from earlier in the day that fooled you into thinking that you are a better trader than you really are.

-

You are competing against computers. They have the edge of speed, so it is usually best not to trade during a report, because that is when their speed edge is greatest. They also have the edge of not being emotional, so don’t trade when you are upset or distracted. Third, they have the edge of never getting tired, so don’t trade when you are worn out, which often happens at the end of the day.

-

Always look for two legs. Also, when the market tries to do something twice and fails both times, that is a reliable signal that it will likely succeed in doing the opposite.

-

Never cherry-pick, because you will invariably pick enough rotten cherries to end up a loser. The good trades catch you by surprise and are easy to miss, and you are then left with the not-so-good trades and the bad trades. Either swing trade and look to take only the best two or three of the best setups of the day or scalp and take every valid setup. The latter, however, is the more difficult alternative and is only for people with very unusual personalities (even more unusual than the rest of us traders!).

-

Finding winners is easy, but avoiding losers is hard. The key to success is avoiding the losers. There can be far more winners each day than losers, but a few losers can ruin your day, so learn to spot them in advance and avoid them. Most occur: in the middle of the range with weak setup bars, like small dojis with closes in the middle; when you are entering a possible reversal too early (remember, when in doubt, wait for the second entry); when you are in denial of a trend and think that it has gone too far so you start taking 1 or 3 minute reversal entries, which turn into great with-trend setups when they fail (as they invariably will); or, when a very credible, well-credentialed technical analyst from a top firm proclaims on TV that the bottom is in, and you then only see buy setups, which invariably fail because the expert in fact is an idiot who cannot trade (if he could, he would be trading and not proclaiming).

-

If you are in a trade and it is not doing what you expected, should you get out? Look at the market and pretend that you are flat. If you think that you would put that trade on at this moment, stay in your position. If not, get out.

-

Do not scalp when you should swing, and do not swing when you should scalp. Until you are consistently profitable, you should keep your trading as simple as possible and swing just one to three trades a day, and do not scalp. To scalp successfully, you usually have to risk about as much as you stand to gain, and that requires that you win on more than 60 percent of your trades. You cannot hope to do that until you are a consistently profitable trader.

-

If you find that you frequently take swing trades, but quickly convert them to scalps, you will probably lose money. When you take a swing trade, you are willing to accept a lower probability of success, but to make money on a scalp, you need a very high probability of success. Similarly, if you take scalps, but consistently exit early with a profit that is smaller than your risk, you will lose money. If you cannot stop yourself from following your plan, simply rely on your bracket orders and walk away for about an hour after you enter.

-

If you lost money last month, do not trade any reversals. If seven of the past 10 bars are mostly above the moving average, do not look to short. Instead, only look to buy. If seven of the past 10 bars are mostly below the moving average, do not look to buy. Instead, only look to short.

-

Beginners should take only the best trades. It is difficult to watch a screen for two or three hours at a time and not place a trade, but this is the best way for beginners to make money.

-

Discipline is the most important characteristic of winning traders. Trading is easy to understand, but difficult to do. It is very difficult to follow simple rules, and even occasional self-indulgences can mean the difference between success and failure. Anyone can be as mentally tough as Tiger Woods for one shot, but few can be that tough for an entire round, and then be that way for a round every day of their lives. Everyone knows what mental toughness and discipline are and can be mentally tough and disciplined in some activities every day, but few truly appreciate just how extreme and unrelenting you have to be to be a great trader. Develop the discipline to take only the best trades. If you cannot do it for an entire day, force yourself to do it for the first hour of every day, and as you increase your position size, you might find that this is all you need to be a successful trader.

-

The second most important trait of great traders is the ability to do nothing for hours at a time. Don’t succumb to boredom and let it convince you that it’s been too long since the last trade.

-

Work on increasing your position size rather than on the number of trades or the variety of setups that you use. You only need to make two points in the Eminis a day to do well (50 contracts at two points a day is seven figures a year).

-

If you perfect the skills of trading, you can make more money than you could ever have imagined possible, and you will have the ability to live your dreams.