1947 年 7 月 13 日,林彪在一封书信中提到了了主观主义对战斗结果的影响:

凡一切主观主义的东西。无论他是美名勇敢或美名慎重,其结果都要造成损失,而得不到胜利的。正确的思想的标准,是包括实践在内的唯物主义,反对唯心主义,在军事上要发挥战斗的积极性,而同时必须从能否胜利的条件出发。凡能胜利的仗,则须很艺术地组织,坚决地打;凡不能胜的仗,则断然不打,不装好汉。如不能胜的仗也打,或能胜的仗如不很好讲究战术,则必然把部队越搞越垮,对革命是损失。

这段文字年代久远,语言表达风格与现在是不一样的。但仔细读,是可以看到里面有几个意思。

第一,主观主义之下,无论是保守,还是冒进,都要不得。

凡一切主观主义的东西。无论他是美名勇敢或美名慎重,其结果都要造成损失,而得不到胜利的。

——一切“勇敢”或“谨慎”,都要基于正确的分析,要准确把握外部环境。失去了这个前提,任何勇敢都是冒进,任何谨慎都是胆小。正确分析外部环境,对交易员来说事关重大。

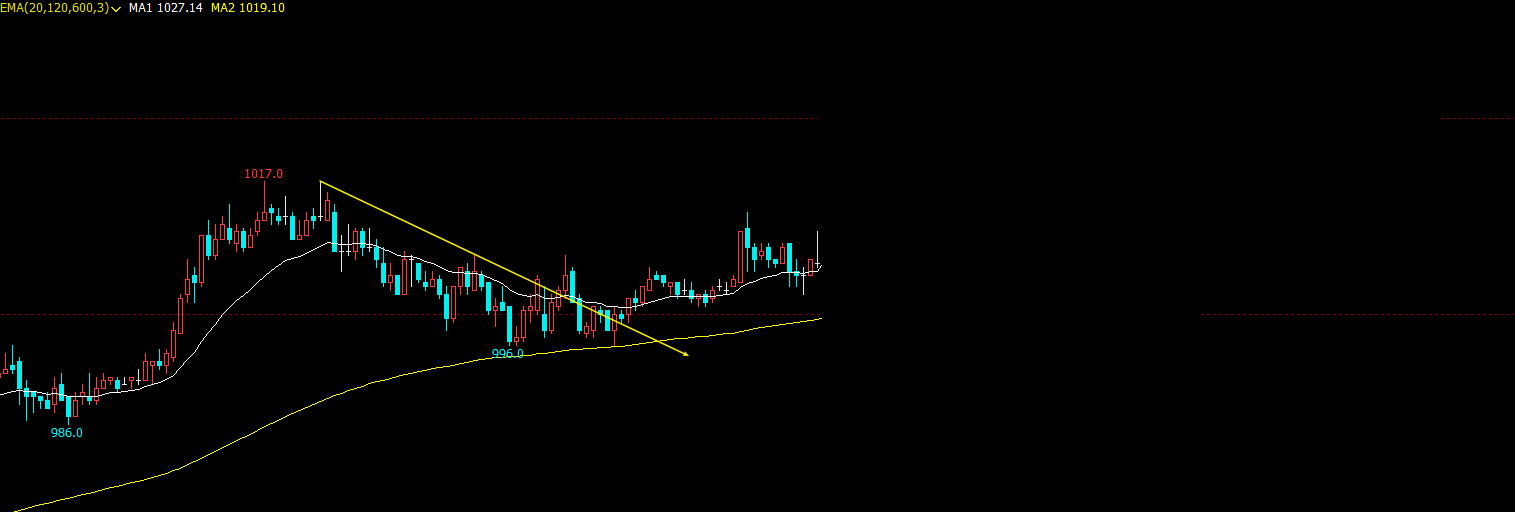

把握外部环境,如 108 课所说,首先要解决的就是什么是“能搞的”,什么是“不能搞的”——选筹是第一位的。选筹错了,就是入错了行,下错了场,再勇敢再谨慎,桥下无水也钓不到鱼。

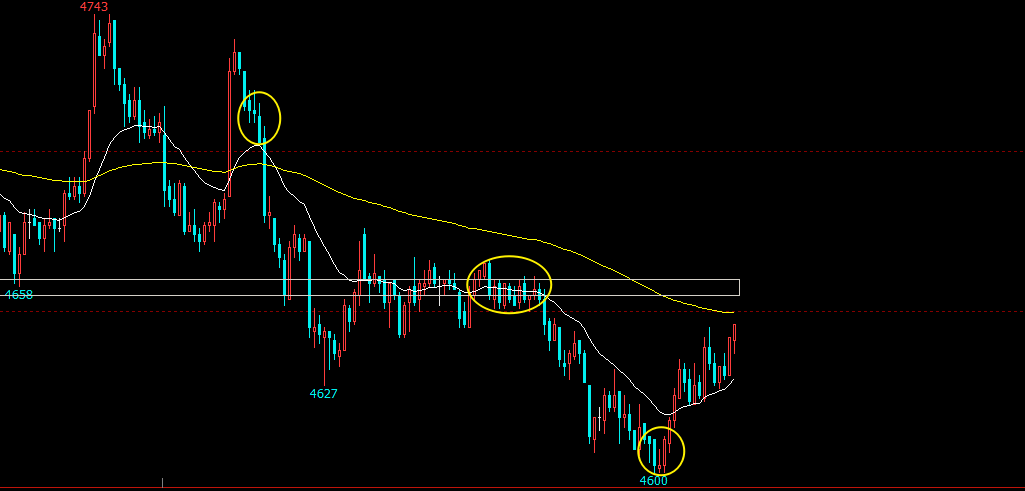

第二件事是判断方向。下对了场子,方向反了一样不行。这里一定要注意“求实”,尊重市场的选择,去除自己的主观判断。这里的方法很多,均线或者趋势性技术指标都可以解决。走势分析更好,不过会复杂一些。

第二,正确的做法,是在分析取胜条件的基础上,发挥战斗的积极性。

正确的思想的标准,是包括实践在内的唯物主义,反对唯心主义,在军事上要发挥战斗的积极性,而同时必须从能否胜利的条件出发。

选好了交易的品种,明确了参与的方向,操作的手法就是首要问题了。做交易不能赌大小,干瞪眼。买定离手的决心要有,但也不是一进赌场的门就梭哈。这里要把握一个原则,还是用 108 课的表达:上涨只考虑卖,下跌只考虑买。要学会回撤入场,永不追单。大级别方向顺着做,等待小级别回撤确认。永远要等待小级别的走势确认了回调结束,才在临界点入场。这个过程,虽然表面上水波不兴,交易者的心中就是一场战斗。

战斗打响的积极性是什么?重手入场。这个重手不一定是重仓,而是按照自己的资金管理规则,坚决地、不打折扣地贯彻执行。打仗要下决心,不要因为流血负伤就犹犹豫豫。开盘前,就要做好这个准备。

第三,面对机会要周密组织,坚决抓住机会;不是机会,则坚决不打,避免损失。

凡能胜利的仗,则须很艺术地组织,坚决地打;凡不能胜的仗,则断然不打,不装好汉。

每一场战斗的环境都是不一样的,每一笔交易也是不一样的。面对回调尾声怎么做,面对盘整如何入场,强势突破如何上车,这些问题的解决办法都是不一样的。要明确的同一个问题是,只要明确了做,那就要在发车时保证足额在线,提前建好仓位。至于左侧还是右侧,随机应变。战场上的形式瞬息万变,没有一定之规。分批也好,一次解决也罢,目的是在行情启动时完成建仓。

相反的,如果实际的走势与计划不符,算计好的东风没来,环境发生了变化,也不能勉强交易,而要“坚决不打”,避免损失。市场的机会每天都有,今天不打仗,明天打赢了,一样是英雄好汉。相反,不具备条件勉强打,则是不敢面对现实的表现。

第四,要坚决避免因错误带来的损失。

如不能胜的仗也打,或能胜的仗如不很好讲究战术,则必然把部队越搞越垮,对革命是损失。

“不能胜的仗不打”,这个好理解。“能胜的仗”也要“讲究战术”,更容易被忽略。

即使是各类信号出现共振,给了提示——“这个品种很可能看涨”,那也不能操之过急,闭着眼睛进场。越是能胜的战斗,圆满的包饺子越能鼓舞士气。越是大阳线,越要争取从最低吃到最高。

小结

林彪的几个意思,对每一个交易者都有启示。更重要的是,这封书信的收信人,是李天佑将军。这段缘分,草蛇灰线,交易者不可不察。